Who to Hire to Represent you Before the IRS and State Taxing Authorities

HIRING THE RIGHT POWER OF ATTORNEY TO RESOLVE BACK TAX ISSUES

Here are some questions you should ask when considering who to hire to represent you or your business when dealing with tax issues:

1. Is the person you are contacting the person who will be actually representing you? Many companies use salespeople who tell you what you want to hear and hand your case over to someone else after you hire them, where you are told a different story. Ask if you can communicate directly with the person who will be handling your case directly with the IRS.

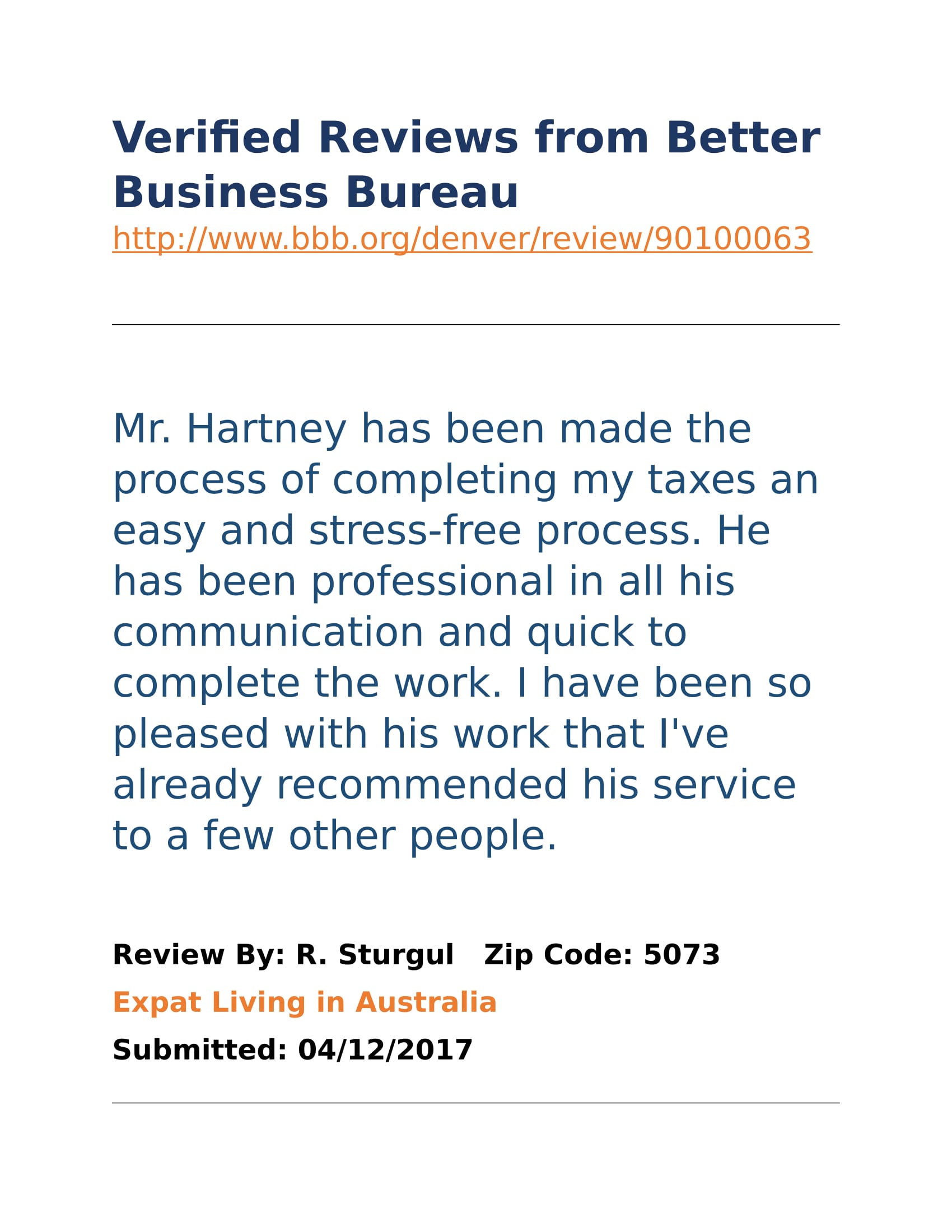

2. Look at the number of Better Business Bureau complaints. It is true that anyone in business long enough, especially in today's age where anyone can write a defamatory post regardless if true or not about anyone, will have a complaint or two. And that is fine as it's inevitable to happen for a variety of reasons, but consider if they have multiple complaints, especially if they are recent complaints.

3. Is a company calling you after a notice of tax lien has been filed? If so, it would be wise to avoid these telemarketing fast talkers. In the legal field these firms are called ambulance chasers and are frowned upon for good reason. Thankfully the IRS has made recent changes making it easier to have a federal tax lien removed as if it never existed if your case is handled appropriately.

Contact me and I will review your case with you, explaining what to expect in the process of resolving your tax issue.

Do You Need to Hire a Tax Attorney or Other Tax Professional?

The truth is not every legal matter requires the use of an attorney and likewise nor does all tax matters. Owing less than $10,000 because you claimed 10 dependents on your W-4 or did not make estimated tax payments on your self-employment are two examples. However, in many other situations involving large amounts of tax owed, or non-filed tax returns, you may not wish to chance the perils of going it alone without the advice of an experienced tax professional who can help you out. In fact, while good professional representation may not be cheap, it can help get you out of a number of sticky situations - such as the abatement of penalties on a large tax bill, arguing for legitimate tax deductions on previous disallowed items, overturning the assessment of the trust fund recovery penalty, or even the settlement of taxes for less than the full amount owed - not to mention the potential alternatives for not using an attorney -- including larger repayment plans, lost deductions, or worse, jail time.

While each person or business' situation is different, there are times when you really should hire a tax professional, whether that be a tax attorney, CPA, or enrolled agent.

Here are the Top 10 Reasons to Hire Representation Before the IRS

1. Tax law is complicated. If you are not a tax professional, you probably have no business acting like one in certain instances. Even experienced lawyers typically do not represent themselves in court. A solid case can quickly unravel without the help of a trained and emotionally detached tax professional. Similarly, failing to hire a tax professional when starting a business, reviewing a contract or embarking on other endeavors with potential legal ramifications can result in otherwise avoidable pitfalls.

2. Not having a tax professional may end up costing you more. What is at stake? A criminal case may determine whether or not you spend time behind bars, while having a civil penalty from being assessed the trust fund recovery penalty could hurt your personal credit. Also, you can claim professional fees if you are a business, so hiring a tax professional can save you money and a lot of headaches.

3. Tax professionals know how to challenge IRS assessments. You may not even know that the IRS improperly issued a tax levy or wage garnishment against you, or that the denial of an expense contradicts the inclusion of income. And did the Revenue Officer properly follow the collection due process every step of the way, or did he trample on your rights? Your tax professional will find out and make sure they follow the rules.

4. Tax professionals understand how to properly fill out IRS collection statements and handle other IRS procedures such as appeals. If you're not a tax professional, you may struggle with the deadlines and protocol for properly filling out and filing certain IRS documents. One late or incorrect filing could derail your case, delay a given legal procedure or worse - have the case thrown out altogether (resulting in enforced collection actions such as a bank levy).

5. Because you don't know how to deal with a bad Revenue Officer who is not following due process. Tax professionals depend on their knowledge and experience to know when to file an appeal, when to speak with the Revenue Officer's Group Manger, or when to use the Taxpayer Advocate's Office to help win their clients' cases. When things go bad with your Revenue Officers most taxpayers have no idea where to turn. Your tax professional will.

6. You're not sure what your options are -- or what a 'CAP' is? Doing what the Revenue Officer says is not the only choice, even if there is evidence showing you have the assets to full pay. A tax professional who understands the IRS procedures will be best situated to explain your options and can help you avoid potentially severe penalties even before your case is assigned to a Revenue Officer.

7. Because it is probably better to avoid problems in the first place rather than try to fix them once they arise. You may have heard the saying "an ounce of prevention is worth a pound of cure?" Well, hiring a tax professional in many instances will help you avoid potential legal headaches down the road. Do you understand the fine print of the Partnership Agreement, the Articles of Incorporation or the Articles of Organization you are signing? A tax professional will.

8. A good tax professional can strike up a good settlement offer in compromise or repayment plan, if necessary. An experienced tax professional probably has seen cases similar to yours or at least knows enough to make a calculated guess about how it might be resolved. Sometimes a settlement (offer in compromise) is the best choice, while other times it is clear you don't qualify to see your case through resolution through an installment agreement, or currently not collectible status.

9. The IRS has legal representation. Taxpayers are generally at a disadvantage when squaring off against Revenue Officers or with ACS. As explained above, tax law is complicated, and the IRS will take advantage of this inequity.

10. Tax professionals (not salespeople, so be careful who you are speaking with) often provide a free initial consultation. Reaching out to a tax professional with a free consultation (either on the phone or through email) will give you an idea of the type of case you have, but it will also help you decide whether you need to hire a tax professional.

Contact me today and I will be happy to help you out.

-Nick Hartney, Licensed to Represent Taxpayers Before the IRS

"Ms. X, we are calling regarding a federal tax lien filed against you (or your business) are you aware of that?"

"Yes, I am."

"Well Ms. X (in pleasant "soft" voice, usually female) I am with Muddy Waters Financial, and we specialize in helping people resolve their back taxes. How much is the IRS claiming you owe?"

"Around X amount."

"OK, hold on for me, we can help."

{Transfers you to the "closer" for a hard sell}

"Hello Ms. X, my name is Seth Gideon, I am a senior consultant here at Muddy Waters Financial. We have been in business since Aramaic was still a spoken language, hire us and all the penalty and interest will stop immediately. If you don't the IRS will levy your bank account!" ...

what to expect after a tax lien is filed *RING*RING*RING*

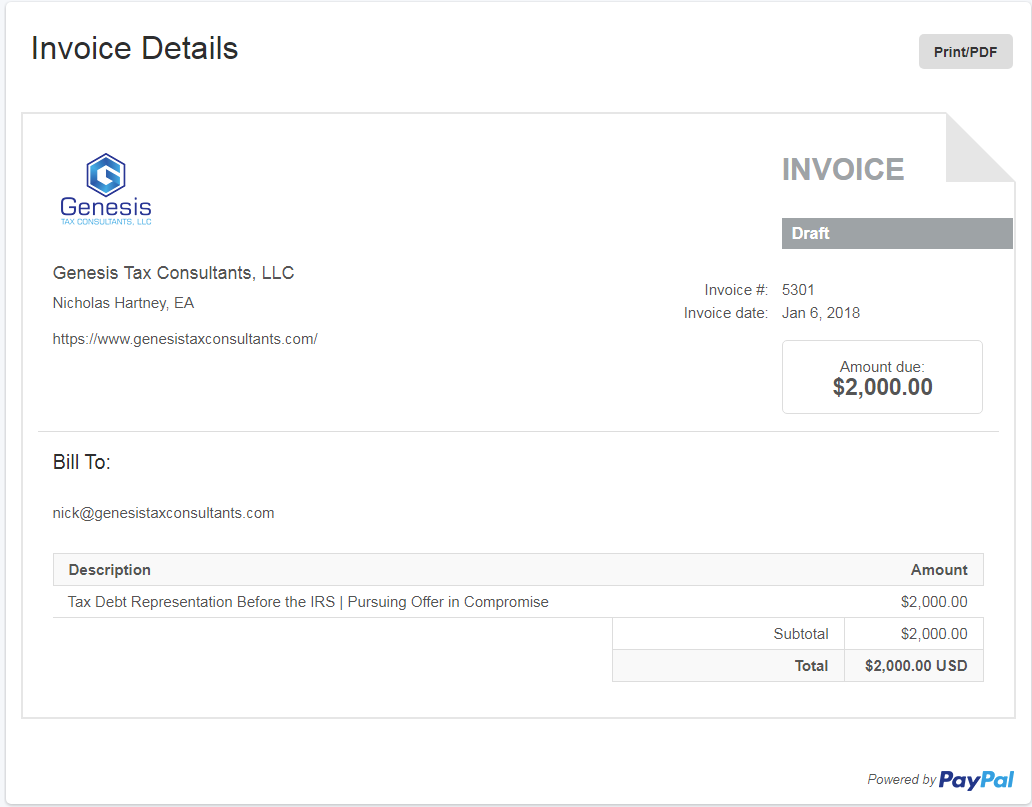

secure invoicing through paypal

➤ locations served

Available for all taxpayers in every state and all Expatriates living abroad.

☎ CONTACT NICHOLAS HARTNEY, EA

nick@genesistaxconsultants.com

and tell me about your situation.

Subscribe, become a Patreon, or Donate for Additional Content

Areas of Practice

expat tax preparation

Foreign earned income and housing exclusions for both federal and state income tax returns. Foreign bank account reporting (FBARs), Statement of Specified Foreign Financial Assets, Tax Treaties, Application for IRS Individual Taxpayer Identification Number,etc.

business tax debt representation

We will file a power of attorney with the IRS and State Taxing Authority to negotiate a hold on all enforcement action such as bank and account receivable levies while we work on an appropriate resolution including Installment Agreements, Company Restructuring, Penalty Abatements, Offer in Compromises, and Currently Not Collectible Status. We will also advise you if bankruptcy is an option.

irs and state tax debt representation

We will file a power of attorney with the IRS and State Taxing Authorities to negotiate an appropriate resolution for back tax debt including Installment Agreements, Penalty Abatements, Offer in Compromises, Innocent Spouse Requests, and Currently Not Collectible Status. We will also advise you if bankruptcy is a option.

new business entity formation

We will educate you of the pros and cons of organizing an Limited Liability Company versus a Corporation, S-Corp., Limited Partnership, etc. and assist in the formation of the entity of your choosing.

previous years tax returns

We will prepare your previous years tax returns to bring you back into compliance with the IRS and State.

business tax return preparation

Whether you have a sole proprietorship with a Schedule C or a 1120 Corporate return we will prepare any business return.

“The hardest thing in the world to understand is the income tax.”

Let's Chat

Use the form below to contact us regarding your legal enquiry. Please be as detailed as possible. Include your industry along with any specific document requests. To help us best service your enquiry, we recommend that you first describe the issue you’re having before telling us what you want to achieve. You may also email or call us to make an appointment.

For job opportunities, please email us your resume. We’re always looking for new and exceptional talent to lead the firm into uncharted fields of practice.